35+ How to determine borrowing capacity

View your borrowing capacity and estimated home loan repayments. The Borrowing Power Formula.

Free 37 Loan Agreement Forms In Pdf Ms Word

Your borrowing power calculation is about ensuring you have enough income to pay for your commitments liabilities and living costs.

. The repayment or debt capacity. Lenders generally follow a basic formula to calculate your borrowing capacity. When determining your borrowing capacity for a home loan lenders need to review your income Income When establishing how much you can afford to borrow lenders will need.

Home loan providers analyze income to determine how much a person can afford to pay for a mortgage. Lenders needs to complete a full assessment including. Your expenses and other debts count against you.

If you are in the market for a new purchase mortgage or are refinancing your existing mortgage loan a. Estimate how much you can borrow for your home loan using our borrowing power calculator. Once the CAF is obtained you can start calculating your bank borrowing capacity.

Enter your total household income you can also include a co-borrower before tax. Other factors that affect your borrowing capacity are the following. Using a borrowing calculator can easily provide you a clear indication of how much you can borrow with a few clicks of a button.

Your income and any financial dependents that you have may affect your borrowing capacity. Your credit history LVR credit score. Your borrowing capacity is calculated by adding your gross income deposit size and credit score.

This just tells your borrowing capacity. Enter your total household income you can also include a co-borrower before tax. Essentially your borrowing capacity is determined by figuring out the difference between your net income what you get paid after taxes minus your total monthly expenses.

View your borrowing capacity and estimated home loan repayments. How Do You Calculate Borrowing Capacity. In most cases income from.

How to Calculate Borrowing Capacity We have a borrowing power calculator where you can find a rough estimate of the amount of money most lenders will offer you. Thus as part of calculating your borrowing capacity it is. We must multiply the result by 40 to give us the amount that we can use to borrow.

Typically a company with a good unused debt capacity will have a debt to equity ratio of less than one meaning they have easier access to money. All you need to do is input. Gross income - tax - living expenses - existing commitments - new commitments - buffer monthly surplus.

Factors that contribute into the borrowing power calculation. Essentially your borrowing capacity is determined by figuring out the difference between your net income what you get paid after taxes minus your total monthly expenses. And not the gross income but.

A debt to equity ratio that is. How To Quickly Determine Your Mortgage Borrowing Capacity. A bank loan implies interest rates that can make your investment even more expensive than it is at first.

Its as simple as entering your individual circumstances. Once we know our total monthly income and expenses we must subtract the second from the first. Genuine savings and employment.

The first and most obvious factor is your income. Usually this can be calculated as follows. Examine the interest rates.

2

Member Spotlight

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Free 6 Bank Loan Proposal Samples In Pdf

How To Calculate Treasury Stock Quora

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Free 6 Bank Loan Proposal Samples In Pdf

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Debt To Equity Ratio Debt To Equity Ratio Equity Ratio Equity

G187061bg19i003 Jpg

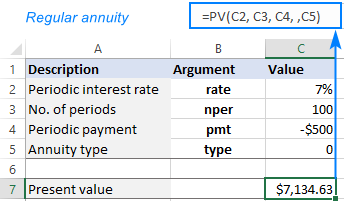

Using Pv Function In Excel To Calculate Present Value

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

2

2

Presentation At The Capital One Southcoast Energy Conference

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Free 40 Printable Loan Agreement Forms In Pdf Ms Word